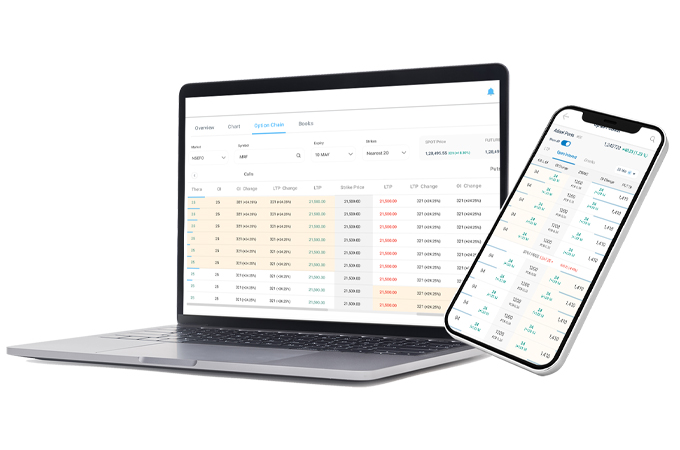

Options Chain

Strategise Confidently with Options Chain Insights

An options chain is a comprehensive listing of all available options contracts for a particular asset, displaying details like strike prices, expiration dates, and premiums. It serves as a crucial tool for traders to analyse and compare different options, helping them make informed decisions based on market trends and volatility.Open Free Demat Account

*T&C ApplyDefining Options Chain

An options chain provides a detailed listing of all available options contracts for a specific asset, including important data like strike prices, expiration dates, and premiums. It’s an essential tool for options traders. Also, it:

- Displays both call and put options for an asset

- Lists multiple strike prices for various expiration dates

- Shows the premium for buying or selling an option

- Offers insights into market sentiment through bid-ask spreads

- Helps traders identify opportunities for hedging or speculation strategies

Types of Options

There are two main types of options: call options and put options, each serving distinct purposes in trading. Call options allow the buyer to purchase an asset, while put options grant the right to sell an asset at a specified price.

There are two types of options: call options and put options.

Call options give buyers the right to purchase a specific quantity of stock at a predetermined price (strike price) on or before the expiration date, with the seller obligated to sell if exercised.

Conversely, put options grant the buyer the right to sell the stock at a specified price within the same time frame.

If a trader buys a call option, they anticipate a rise in the stock price; buying a put option indicates an expectation of a decline, allowing for favourable outcomes through strategic buying and selling.

How to Read Option Chain Data

Consider an example of TCS Wed Mar 29 2023 with a strike price of 2500.

- LTP (Last Traded Price): Most recent trading price of the option.

- Net Change: Price change from the previous session; green for positive, red for negative.

- Bid Quantity: Number of buy orders at a specific strike price, indicating demand.

- Ask Quantity: Number of open sell orders at a specific strike price, indicating supply.

- Bid Price: Price in the last buy order; a higher bid than the LTP suggests rising demand.

- Ask Price: Price in the last sell order.

| Feature | Options Chain | Price Action |

|---|---|---|

| Definition | A table listing all contracts for a specific underlying security currently available. | The study of price movements of a financial asset over time using charts. |

| What It Measures | Implied volatility, open interest, and volume of the underlying security. | Price of the underlying security, trend, and support/resistance levels. |

| How To Use It | Assess the trading environment and make informed trading decisions. | Identify trading opportunities and make informed trading choices. |

How to Read an Options Chain

To view an options chain, enter the stock ticker and select an expiration date. The chain will display key details for each option contract, including strike price, symbol, last price, change, bid, ask, volume, and open interest.

To read an options chain, start by entering the stock ticker (a unique series of letters assigned to a particular publicly traded company or stock for identification purposes) and choosing an expiration date.

The chain presents essential data for each contract, such as the strike price, option symbol, last traded price, daily change, bid and ask prices, volume, and open interest.

The strike price is the predetermined price for executing the option. The change represents the difference from the previous day’s closing price.

Bid and ask prices indicate the buying and selling interest.

Additionally, the chain displays the days until expiration (DTE) and colour codes for in-the-money (ITM) and out-of-the-money (OTM) options, helping traders make informed decisions based on their strategies.

Benefits of Analysing Option Chain Data

Detecting Market Sentiment:

High open interest and volume in call options indicate bullish sentiment, while high put options suggest bearish sentiment among traders.

Setting Price Ranges:

Analysing strike prices with the largest open interest and volume can provide insight into the expected price range of the underlying asset, helping traders gauge potential price movements.

Options Pricing:

Traders can assess the implied volatility (IV) to determine whether an option is overpriced or underpriced compared to the historical volatility of the underlying asset.

Learn from Our Blogs on Options Chain and Trading Tips!

06 Sep, 2024

06 Sep, 2024What is an Options Chain? Essential Concepts Every Trader Should Know

What is an Options Chain? An options chain is a tabular representation of all available call and put options contracts for a specific underlying asset, such as a stock or index. It provides essential information about each option, including its strike price, expiration date, premium (price), bid and ask prices, open interest, and implied volatility. […]

07 Sep, 2024

07 Sep, 2024How to Read and Interpret an Options Chain: A Comprehensive Guide

Understanding the Options Chain An options chain is a tabular representation of all available call and put options contracts for a specific underlying asset at various strike prices and expiration dates. It’s a crucial tool for traders to analyse and make informed decisions about their options strategies. Key Components of an Options Chain To effectively […]

09 Sep, 2024

09 Sep, 2024How Open Interest in Options Can Predict Market Movements: Key Indicators to Watch

In the world of financial markets, grasping the intricacies of options trading may offer insightful information on possible movements in the stock market. Among these measures utilised by traders, open interest is one key indicator. In terms of options, what does open interest stand for and how can it be used as a guide to […]